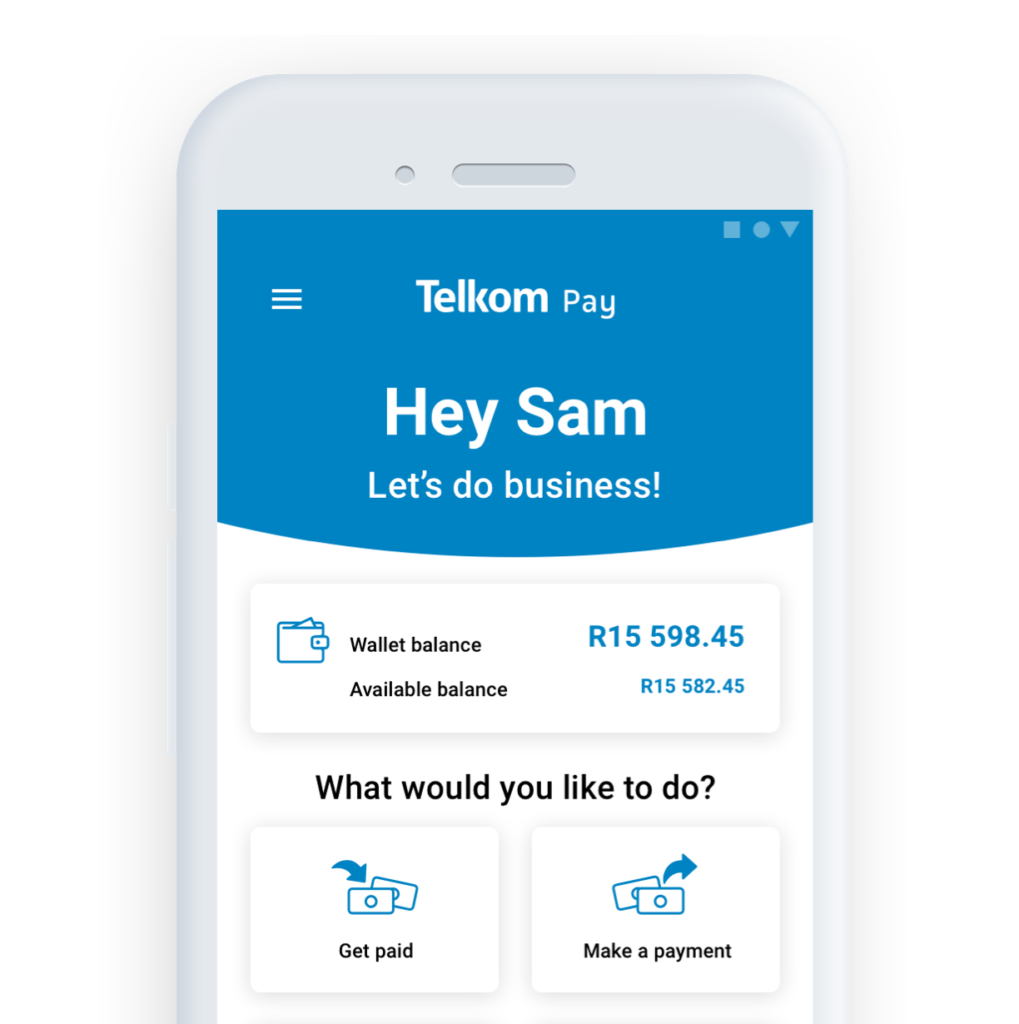

Telkom Pay mPOS allows your customers to quickly and securely pay you by tapping their card or device on your NFC enabled phone (Android phones only) or generating a QR code. You can also make payments with your pre-paid virtual card or by scanning any Scan to Pay by Masterpass or Snapscan QR code.

You will need to verify your identity through a KYC (Know Your Customer) process for your safety. This process can be done on your phone, with no paperwork or branch visits required. You will be asked to upload your South African identity document, valid passport or driver’s license. If you are not a South African citizen, you can upload your valid passport or asylum document. Next, you will be asked to take a ‘selfie’ with a ‘thumbs up’ to compare to the image on the document you have just uploaded. Verification is instant, and if successful you will be able to start transacting immediately.

You will need to have an iOS or Android smartphone with the latest operating system. To use ‘Tap to Get Paid’ to allow your customers to tap their cards on your phone to make a payment, you will need to have an NFC enabled Android phone.

Telkom Pay mPOS allows your customers to quickly and securely pay you by tapping their card or device on your NFC enabled phone (Android phones only) or generating a QR code. You can also make payments with your pre-paid virtual card or by scanning any Scan to Pay by Masterpass or Snapscan QR code.

No, anyone with a valid South African ID, drivers licence, valid passport or asylum document can use Telkom Pay mPOS.

To make a withdrawal tap your wallet from the home screen and select ‘Withdrawal or make an EFT’. Enter your bank details and review the details to ensure it is correct. Payments will reflect in your bank account within 24 – 48 hours on weekdays if the transaction is successful.

No, you don’t have to be a Telkom customer. Any South African citizen with a valid South African ID, passport or drivers licence and any foreign national with a valid passport or asylum document can use Telkom Pay mPOS.

Select ‘Get Paid’ from the main menu and then select ‘Generate a QR code’. Enter the amount your customer owes, an optional description for the transaction and generate the QR code. Your customer can pay with a bank app that can pay QR codes or any scan to pay Masterpass app.

Tap to Get Paid works like a card machine on your phone. Enter the amount your customer owes you and an optional description of the transaction. Next, allow your customer to tap their ‘tap’ enabled card or device on your phone within the allowed time frame. For a higher amount, the customer will need to enter their PIN to approve the transaction. Tap to get paid currently only works on NFC Android phones.

Depending on your bank, payments may take one to four business days to reflect in your account. You may expect delays on public holidays and weekends.

Telkom Pay mPOS allows your customers to quickly and securely pay you by tapping their card or device on your NFC enabled phone (Android phones only) or generating a QR code. You can also make payments with your pre-paid virtual card or by scanning any Scan to Pay by Masterpass or Snapscan QR code.

Select ‘Make a Payment’ from the main menu and then select ‘Withdrawal or make an EFT’. Enter the recipient’s bank details, review the details to ensure that they are correct. Payments will reflect in your recipient’s bank account within 24 – 48 hours on weekdays if the transaction is successful.

Select ‘Virtual Card’ from the main menu. You can top up your card with your main wallet or make a withdrawal by moving money from your virtual card back to your main wallet.

From the main menu, select ‘Virtual Card’. You will need to complete a few mandatory security questions before your virtual card is created. You can use your virtual card to pay for online purchases and services. View your card details by tapping on the eye icon. Remember to top up your card to make payments. You can also temporarily deactivate or cancel your virtual card.

You can only have one active virtual card. Creating a virtual card is optional.

Telkom Pay mPOS allows your customers to quickly and securely pay you by tapping their card or device on your NFC enabled phone (Android phones only) or generating a QR code. You can also make payments with your pre-paid virtual card or by scanning any Scan to Pay by Masterpass or Snapscan QR code.

You will need to have an iOS or Android smartphone with the latest operating system. To use ‘Tap to Get Paid’ to allow your customers to tap their cards on your phone to make a payment, you will need to have an NFC enabled Android phone.

Select ‘Make a Payment’ from the main menu and then select ‘Withdrawal or make an EFT’. Enter the recipient’s bank details, review the details to ensure that they are correct. Payments will reflect in your recipient’s bank account within 24 – 48 hours on weekdays if the transaction is successful.

To make a withdrawal tap your wallet from the home screen and select ‘Withdrawal or make an EFT’. Enter your bank details and review the details to ensure it is correct. Payments will reflect in your bank account within 24 – 48 hours on weekdays if the transaction is successful.

Telkom Pay mPOS allows your customers to quickly and securely pay you by tapping their card or device on your NFC enabled phone (Android phones only) or generating a QR code. You can also make payments with your pre-paid virtual card or by scanning any Scan to Pay by Masterpass or Snapscan QR code.